Contents

Courtesy of babypips.comThe picture to the right explains the different forex lot sizes. What lot size in forex refers to is the amount you are risking when you enter a trade in a currency pair. How much will your bank account fluctuate per pip if you grab a standard lot? If the exchange rate is 119.80, you’ll need to multiply that by .01 , and then by 100,000 . You can see now that your potential profits are $8.34 per pip.

The specific amount of currency assigned to a lot is known as a lot size. A nano lot size refers to any number of units of a currency pair that is less than 1000. Forex traders do not use it often due to its small size. When a trader with $1,000 selects a platform in which mini lots are the minimum position size that can be traded, then the account will be very open to risk and may encounter a margin call. Beginners in forex trading are mainly advised to trade with mini, micro, or nano lots so as to prevent the risk of the huge potential losses.

HOW IS LOT SIZE CALCULATED IN FOREX?

The loss of a few dozens of cents turns into a few dozens of dollars. The acceptable risk level for all open trades, which each trader determines for themselves. To optimize the position volume in relation to the deposit amount, considering the risk and the expected profit. To develop and upgrade strategies, test Expert Advisors on a real account. Forward testing will not give full confidence in the trading system’s performance in the real market. If the trading strategy is profitable on a cent account, it will work on a regular account as well.

If you’re day trading and only going to be risking 100 pips or less, then you could potentially get away with a micro lot account. $1 per pip seems like a small amount but in forex trading, the market can move 100 pips in a day, occasionally even in an hour. To trade a mini account, you should start with at least $2000.

When you buy a currency, you will use the offer or ASK price. Remember, when you enter or exit a trade, you are subject to the spread in the bid/ask quote. Understanding how margin trading works is so important that we have dedicated a whole section to it later in the School. No problem as your broker would set aside $1,000 as a deposit and let you “borrow” the rest. The amount of leverage you use will depend on your broker and what you feel comfortable with.

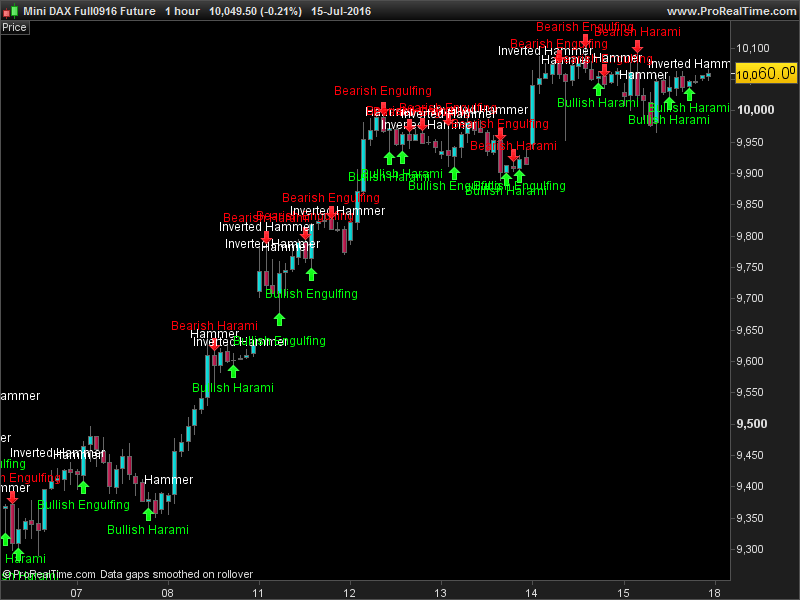

A table showing the pip value for various lot sizes in USD/JPY and any currency pair with USD as the quote currency

It is the short section of the blue line in the chart, which is directed upward. What is the level of allowable drawdown and at what level should you place your stop https://1investing.in/ loss? Based on the volume of the position and, accordingly, the value of the point, the trader estimates the level of volatility and determines the stop loss point.

- This is more rare as you can barely eke out a noticeable profit with an investment of this size, but many top brokers for forex trading do still offer it.

- Please note that the pip value in USD calculated here is the same for any currency pair where the USD is the quote currency.

- As you may already know, the change in a currency value relative to another is measured in “pips,” which is a very, very small percentage of a unit of currency’s value.

- How much money are we profiting or losing per each PIP that our trade moves taking into account the quantity of currency that we chose to trade with.

- You might start with a demo account, then move into nano or micro lots, and then accrue the capital and market knowledge to take on mini lots and standard lots.

At times of increased volatility, reduce the volume of transactions. There is a small profit of 1.07 USD from the first minutes. Thus, the lot volume depends on the drawdown the trader allows in the calculations. Here, the simple model in Excel will show the dependence of the lot on the drawdown . The minimum security for each lot will vary from broker to broker.

The PIP value per LOT size answers this question and does so with a result expressed using the base currency, then you can convert it into whatever currency you desire. How much money are we profiting or losing per each PIP that our trade moves taking into account the quantity of currency that we chose to trade with. A PIP is the smallest price measurement change in a currency trading. In the case of EUR/USD a PIP is worth 0.0001, in the case of USD/JPY a PIP is worth 0.01. When you buy 1 lot of this currency pair, which is equivalent to 100,000 USD, you tend to buy $140,000 (100,000 x 1.4).

But, it’s a little more beginner-friendly, as long as you have a decent amount of capital. A pip change will represent $1 in your bank account – though be aware that currencies can move 100 pips or more in a day, so that can still add up. Many traders suggest starting with at least $2,000 before trading mini lots. In the past, spot forex was only traded in particular lots – so you could get 100 units of currency, or 1,000, but not 565, or whatever your favorite number is. Now, non-standard lots have become available to more and more traders. With forex reserves rising to an all-time high of $608 billion, it’s a great time to cash in using lots to standardize your trades.

We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey. So now that you know how to calculate pip value and leverage, let’s look at how you calculate your profit or loss. We will now recalculate some examples to see how it affects the pip value. Someone with $100,000 dollars in their account would not open a nano lot to trade.

This position size calculator is for educational purposes only. A 0.01 lot in Forex is the micro lot and comes with a value of $0.10 based on the EUR/USD currency. While it is enough for you to risk losing some capital, it’s not a reason to panic if the market goes against you.

Why Does Lot Size Matters in Forex Trading?

Please note that the pip value in USD calculated here is the same for any currency pair where the USD is the quote currency. Hedging is when your broker allows you to hold both long and short positions in the same trading account. You’ll Reasons for autocorrelation in time-collection residuals have to make your decisions on which lot size is right for you, but knowing the right lot size before your first trade will get you started on the right foot. But in Forex, there are some preset “packages” of lot size units.

The relation between these two concepts is that both these figures affect the total trade cost. The difference is that this influence is made in opposite directions. The larger is the lot size, the larger is the transaction volume , and, consequently, its value . However, the higher is the leverage, the less money is required for the trade margin and therefore, the less is the trade cost. Another useful and closely related type of calculator commonly employed for risk management purposes that you can find online is a position sizing calculator.

The mini lot is 1/10th of a standard lot and has a value of 10,000 units. On the EUR/USD the pip value of a micro lot is around $0.10, so every time the market moves up or down 1 pip, you generate 10 cents profit . Micro lot which is 1/100th of a standard lot.So the value of a micro lot is 1,000 units. In this article, we are going to break down the question “what is lots size in forex” and help you understand this fundamental concept when trading forex. Leverage is a tool that increases the purchasing power of the trader’s deposit.

How do you calculate forex profit?

It is important to note that the lot size directly impacts and indicates the amount of risk you’re taking. I help others find financial freedom and success with forex trading. The movement of pips can correspond to profit or loss, but they do not have inherent value.

Your equity – This is the amount you have in your trading account. If your base currency was the US Dollar, then you already got your result expressed in US Dollars. If your base currency was any other, you can convert the result of your formula to any other currency you choose.

Also, if you bought a new expert advisor or are trying a new trading strategy, it is smart to use nano lot for the first few weeks. Nano lot, named cent lot by some forex brokers, is equal to either 100 or 10 units. In some forex brokers, nano lot refers to 10 units while in some other brokers, it may refer to 100 units. If you are a novice and you want to start trading using mini lots, be well capitalized.

Typical Sized Lots in Forex Trading Available at Online Forex Brokers

A Demat account is a kind of simulator, while the nano account is real trading in real market conditions. That is why beginner traders, moving on from demo accounts, start from cent accounts. Regular accounts do not allow to make transactions for such small volumes. Not only the transaction volume, i.e., investment, is 1000 times less, but also your potential profit is 1000 times less. So, professional traders, who want to recoup the time spent and make real profit, do not use cent accounts. In the first step, we need to calculate risk in dollars, then calculate dollars per pip, and in the last step, calculate the number of units.